Your Premier Partner for Mutual Funds, SIP, SWP & Retirement Planning

Nidhi Capital (AMFI Reg: ARN-116800): Expert Retirement Planning and wealth solutions, exclusively crafted for High Net Worth Individuals across India.

The Nidhi Capital Advantage for HNWI

HNWI-Centric Strategies

Bespoke Mutual Fund, SIP, and SWP strategies for your unique financial ambitions.

Proven Expertise & Results

20+ years of market mastery driving optimal, risk-adjusted returns in Indian Mutual Funds.

Unwavering Trust & Compliance

Invest confidently with Nidhi Capital, your SEBI Registered Distributor (ARN-116800) for transparent Retirement Planning.

Nidhi Capital = Your Investment Solution

We are leading experts in crafting personalized strategies encompassing Mutual Funds, SIP, SWP, and comprehensive Retirement Planning for HNWIs.

Dynamic Equity Mutual Funds

Growth Engine for Your Portfolio

Maximize long-term capital appreciation with expertly managed equity Mutual Fund portfolios focused on India's potential.

Discuss Equity GrowthDisciplined SIP Investment

Nidhi Capital = Smart SIP Planning

Build substantial wealth via compounding. Nidhi Capital structures powerful SIP plans for Retirement Planning or other goals.

Calculate Your SIP PotentialStrategic SWP Solutions

Nidhi Capital = Reliable SWP Income

Secure regular income post-retirement with Nidhi Capital's Systematic Withdrawal Plan (SWP) strategies. Key for effective Retirement Planning.

Model SWP ScenariosComprehensive Retirement Planning

Nidhi Capital = Secure Retirement

Partner with Nidhi Capital for holistic Retirement Planning, integrating Mutual Funds, SIP, and SWP for your ideal future.

Estimate Retirement CorpusIntelligent Debt Mutual Funds

Stability & Capital Protection Focus

Navigate market volatility. Our debt Mutual Fund solutions prioritize capital preservation and stable returns for balanced portfolios.

Explore Stability OptionsGlobal Investment Access Via Mutual Funds

Diversification Beyond Indian Borders

Expand your portfolio's reach with curated Mutual Funds that give you access to Global Securities.

Discuss Global DiversificationWhy Nidhi Capital is Investor's Choice

Our dedication to HNWI success in Mutual Fund investing, SIP planning, SWP strategy, and Retirement Planning sets us apart.

20+ Years

Investment Mastery

4000+

Satisfied HNWI Clients

Research-Driven

Data-Backed Decisions

HNWI Specialization

Personalized Guidance

Nidhi Capital Calculators: Plan Your Future

Empower your financial decisions. Use Nidhi Capital's calculators for SIP growth projection, Retirement Planning needs, SWP income modeling, and visualizing your Mutual Fund journey.

SIP Growth Projection

Potential SIP Outcome

Enter your SIP details to see how your investment could potentially grow over time through compounding.

Lumpsum Growth Projection

Potential Lumpsum Outcome

See the potential future value of your one-time investment based on expected returns.

Goal SIP Planner

Required SIP for Your Goal

Find out the estimated monthly SIP needed to reach your financial target within the specified time.

Retirement Corpus Estimator

Retirement Planning Projection

Estimate the corpus you might need at retirement and the SIP required to potentially achieve it.

SWP Sustainability Calculator

SWP Sustainability Analysis

Estimate how long your corpus might last based on your withdrawal strategy and expected returns.

Cost of Delaying SIP

Impact of Investment Delay

See the potential opportunity cost (wealth lost) by delaying the start of your SIP investment.

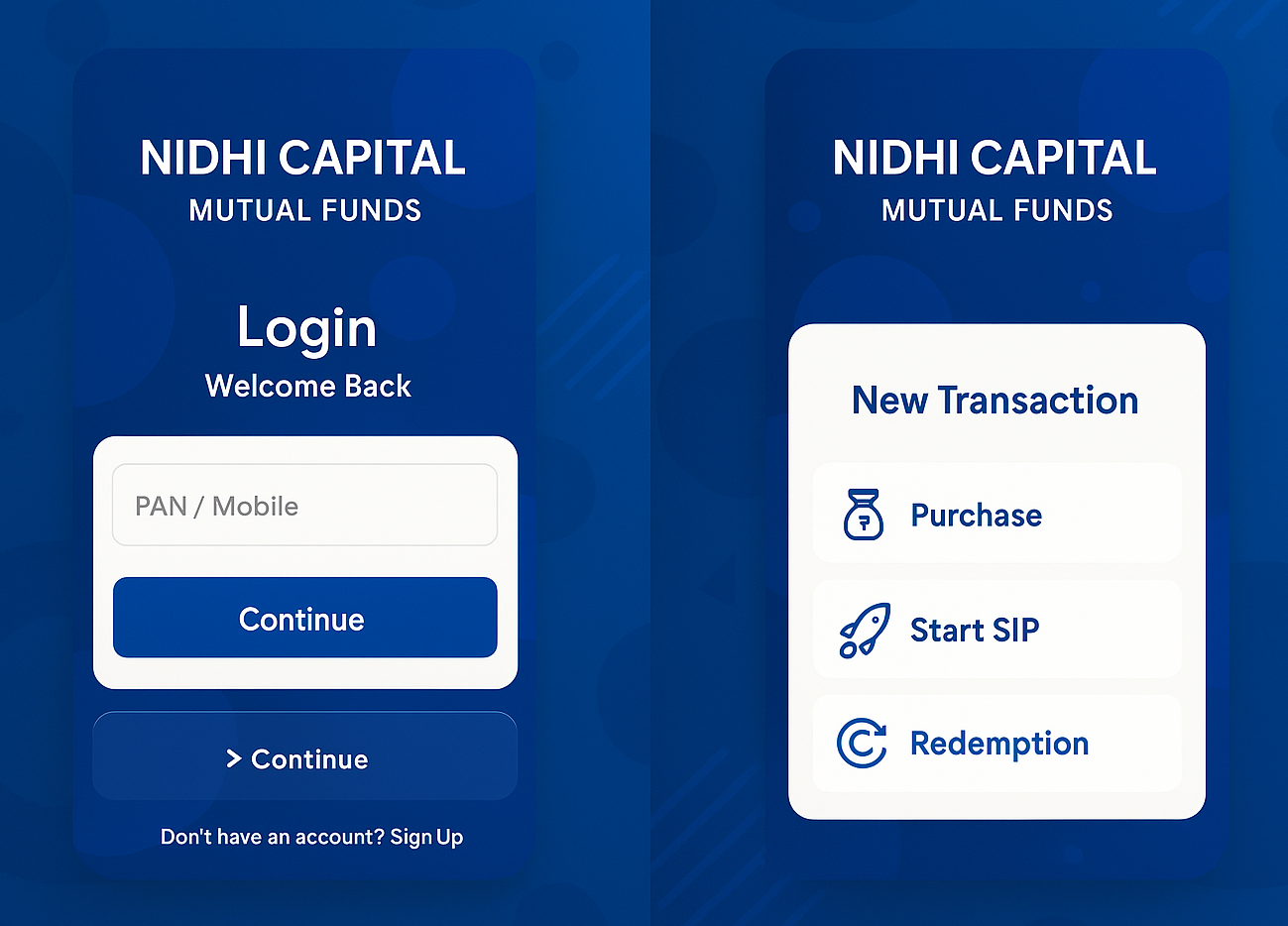

Manage Your Mutual Funds On The Go

Track your Nidhi Capital portfolio, monitor SIP performance, and manage investments seamlessly with our secure mobile app (powered by NSE NMF Transaction Platform). Download now!

Nidhi Capital Insights: Mutual Funds, SIP, Retirement

Partner with Nidhi Capital

Financial Advisors & Distributors: Collaborate with Nidhi Capital to offer premier Mutual Fund, SIP, and Retirement Planning solutions.

Become a Nidhi Capital Partner